Asset Protection Services of America Trust

Asset Protection Services of America Trust

and copyrighted materials, and an Incorporation Service Provider (ISP) with offices in both Nevada and Wyoming.

Contact Us today and let us help you "Cover Your Assets". Learn more About Us, read our Client Testimonials, purchase our Books, visit our Company Store, watch our Videos, utilize our Sitemap or download our Order Forms.

Videos

Click Any Image

Schedule your Free Asset Protection Consultation now!

APSA Webinars

by Jay Butler

Is a "Series" Limited Liability Company akin to putting all your eggs in one basket or can a Series LLC truly provide asset protection through the segregation of subsidiary assets and liabilities?

Originally designed to assist investment companies in the mutual fund industry avoid a multitude of SEC filings, Delaware introduced special interest legislation in 1996 to enable one company to act as an ‘umbrella’ for the activities of all their individual client funds. Such a strategy has also been successfully implemented internationally with...

by Jay Butler

A Revocable Living Trust is a document created while you are still alive and may be amended or revoked by you at any time. In order to best understand how a revocable living trust can benefit you, it is helpful to first understand...

by Jay Butler

by Jay Butler

Low-Risk Assets are assets of intrinsic value which are not subject to creating a lawsuit such as cash, stocks, bonds, CDs, gold and silver, furs, jewelry and artwork, etc.

High-Risk Assets are assets of intrinsic value which may cause a lawsuit such as your home, cars, boats, planes, equipment, rental properties and businesses, etc.

Low-Risk and High-Risk Assets are like oil and water in that they do not mix! Why not? Because of the difference between “Inside and Outside Lawsuits” which is our focus today....

by Jay Butler

Originally the ‘Charging Order’ came into existence under the 1914 passage of the Uniform Partnership Act (UPA), but it had unintended consequences for other partners in that a judgment creditor could force the seizure of partnership assets and sell the debtor partner’s interests, often causing a compulsory dissolution....

by Jay Butler

So, in our scenario, “Bob” previously invested into a duplex. At the time of his purchase, he put $200,000 down toward his $500,000 acquisition. Over the years he invested another $200,000 improving the two units and eventually took-back $200,000 in depreciation. The property values continued to grow in his area and, when he decided to sell, the duplex had appreciated to...

Asset Protection

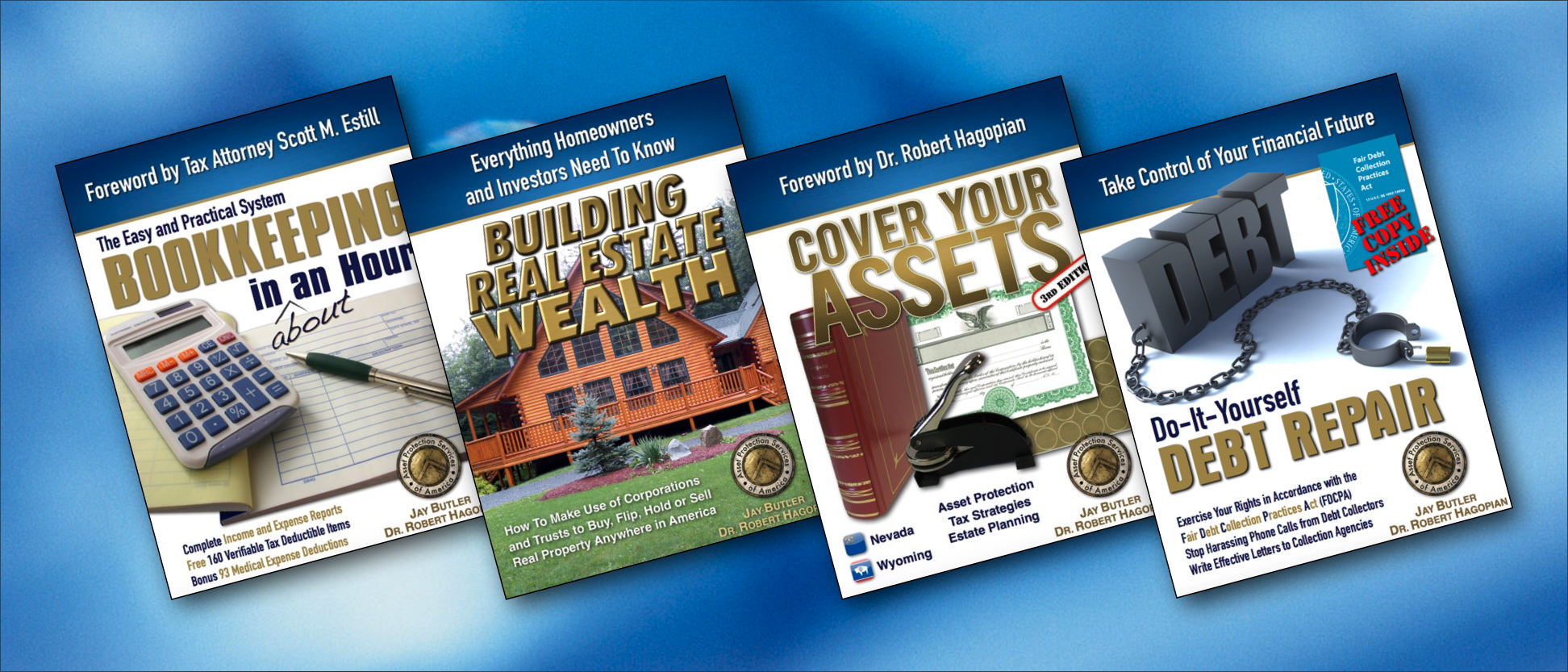

It is imperative, therefore, that you understand the difference between “Inside and Outside Lawsuits” as explained in our publication “Cover Your Assets (3rd Edition)”. Personal liability protection varies greatly from one State to the next and knowing in which states it is preferable to incorporate is paramount to your overall success.

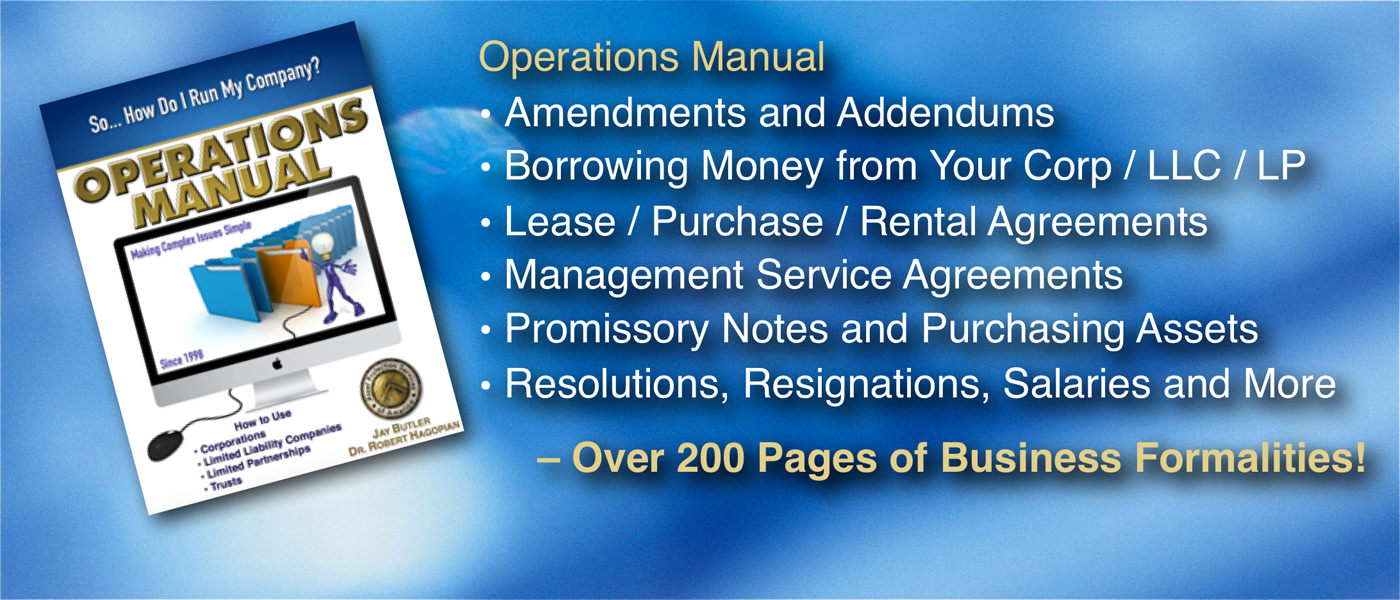

Knowing how to best make use of “Land Trusts” when holding title to real property is of tremendous help to real estate investors. Our publication entitled “Operations Manual” provides you with nearly 250 pages of forms on “How To” make the most out of your entity including resolutions, agreements, contracts, minutes, meetings and much more!

Tax Strategies

In our publication “Bookkeeping in About an Hour”, with a foreword by Tax Attorney Mr. Scott M. Estill, we alphabetically list every “Tax Deductible Item” and “Medical Expense Deduction” we could locate in the Internal Revenue Code for entities filing an 1120 tax election. Each deduction listed is provided with the corresponding Standard Federal Tax Report Paragraph, Revenue Ruling, Code Section and/or Regulation.

When "Incorporating Offshore" or obtaining "Economic Citizenship", as described in our respective publications, be very careful when researching 'international tax havens'. Although other countries may not possess any tax liabilities for Ultimate Beneficial Owners (UBO) in their jurisdiction, that does not mean you are void of any tax consequences in your tax-resident country. Remember, in the United States, “all worldwide income, wheresoever derived, is taxable!”

Nevada

732 South 6th Street

Suite N

Las Vegas, NV 89101

Office (775) 461-5255

Fax (775) 461-1155

Wyoming

30 North Gould Street

Suite N

Sheridan, WY 82801

Office (307) 215-7701

Business Hours

Monday – Friday

8 Hours a Day

9:00 to 17:00 – Eastern

8:00 to 16:00 – Central

7:00 to 15:00 – Mountain

6:00 to 14:00 – Pacific

Closed on Holidays

Primary Services Include

Sitemap

Corporations

C Corp

S Corp

Non-Profit Corp

Limited Liability Companies

Single-Member LLC

Multi-Member LLC

Series LLC

Limited Partnerships

Limited Partnership

Trusts

Land Trust

Irrevocable Spendthrift Trust

Do You Know Jesus?

“Equipping a warrior class of Christians for the days ahead... to be a confident,

resolute, enduring, forcible and effective people who know their God.

A people whose identity is deeply rooted in the Living Water of Christ Jesus

and who boldly stand in His power as they go forth and do exploits!"

~Jamie Walden

.jpg)

.jpg)

.png)

.jpg)

.jpeg)

.jpg)

.jpg)

.png)